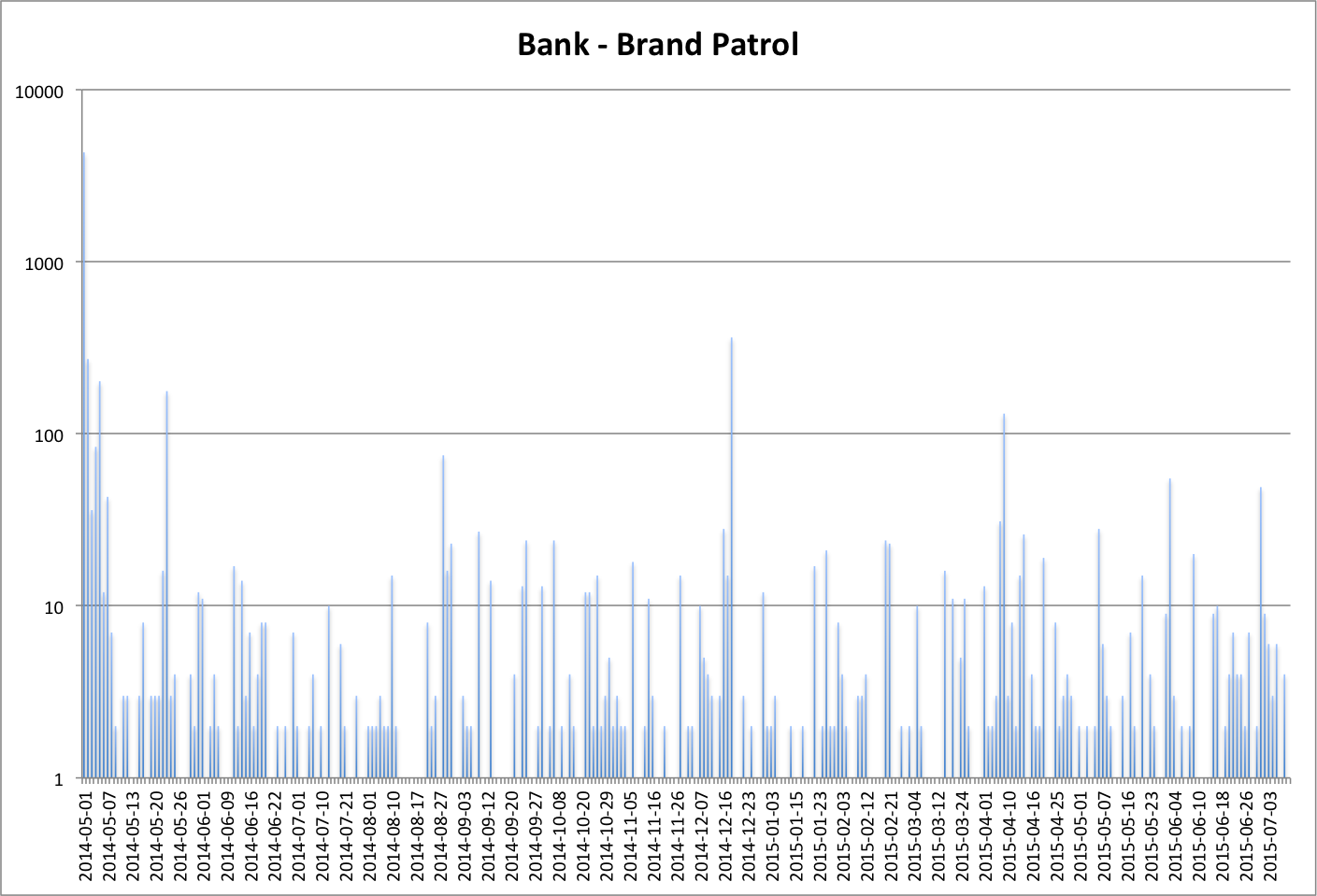

Many companies come to us with the request "Can you run a social media audit so we can update our spreadsheet(s)?" While the answer is "Yes, we can..." there is a very big caveat: "... but your data will be out of date very quickly.”

Unfortunately, social media is not like an email address or phone number which the company can control who gets one, when and for how long. Twitter, Facebook, LinkedIn, etc. all operate by their own rules. Anybody, inside or outside your company can create a new (or modify an existing) social media presence (or new domain) that purports to represent your business...and this can happen on a daily basis. which makes auditing your social media presence a challenge.

The challenge with conducting an audit for web and social media accounts is that the web is a dynamic world and a single audit that produces a static spreadsheet is out of date the moment it is completed.