It's been almost two years since the FFIEC has issued its final guidance on social media for all businesses supervised by the CFPB. We've spent a lot of time talking about how regulated businesses can create social media governance programs and we've offered tips and ideas along the way for attaining social media compliance for mortgage companies.

It's been almost two years since the FFIEC has issued its final guidance on social media for all businesses supervised by the CFPB. We've spent a lot of time talking about how regulated businesses can create social media governance programs and we've offered tips and ideas along the way for attaining social media compliance for mortgage companies.

In our blog post Social Media Compliance & Your Sales Team: 6 Steps to Success, we suggest a process to help secure compliance with your loan officers. Step number five of that process is to "train your sales staff". One of the best ways to train employees on social media compliance is to give them examples and guidelines on what, exactly, you would like them to do with their social media accounts!

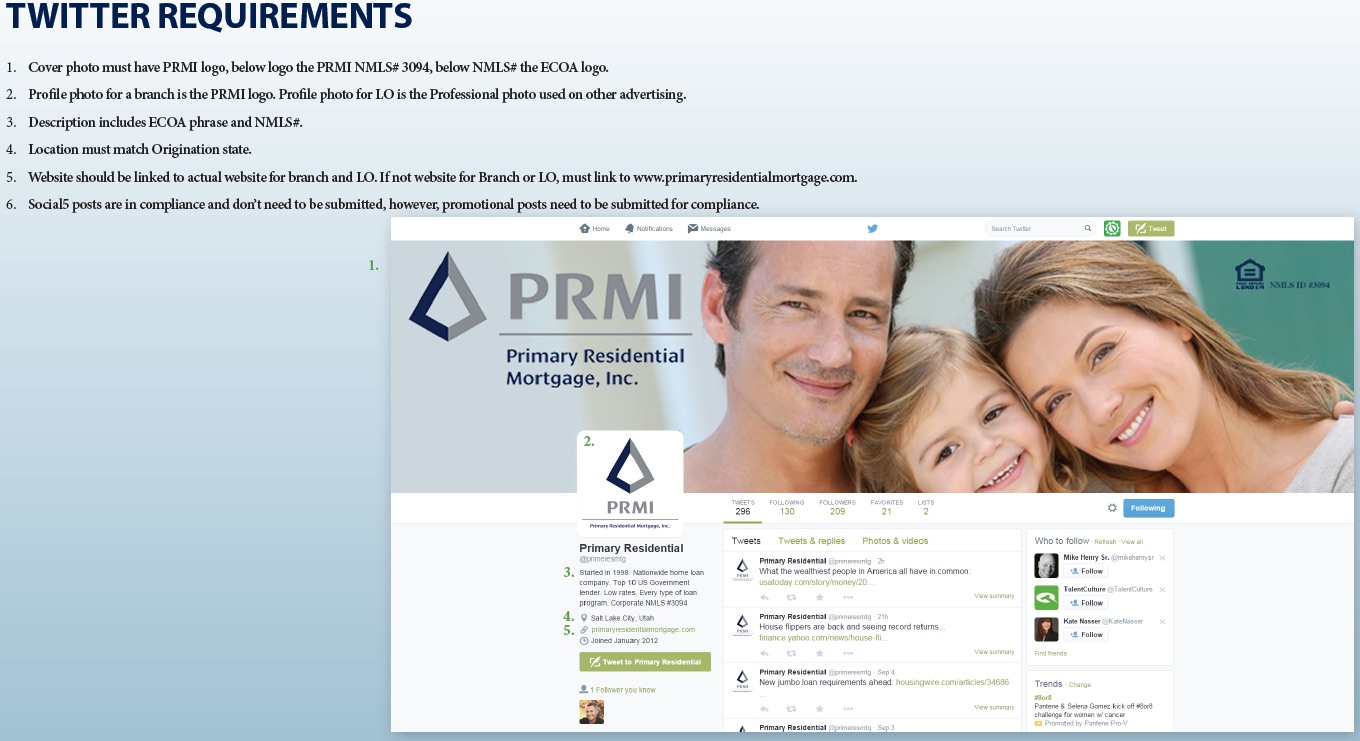

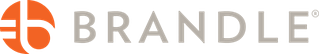

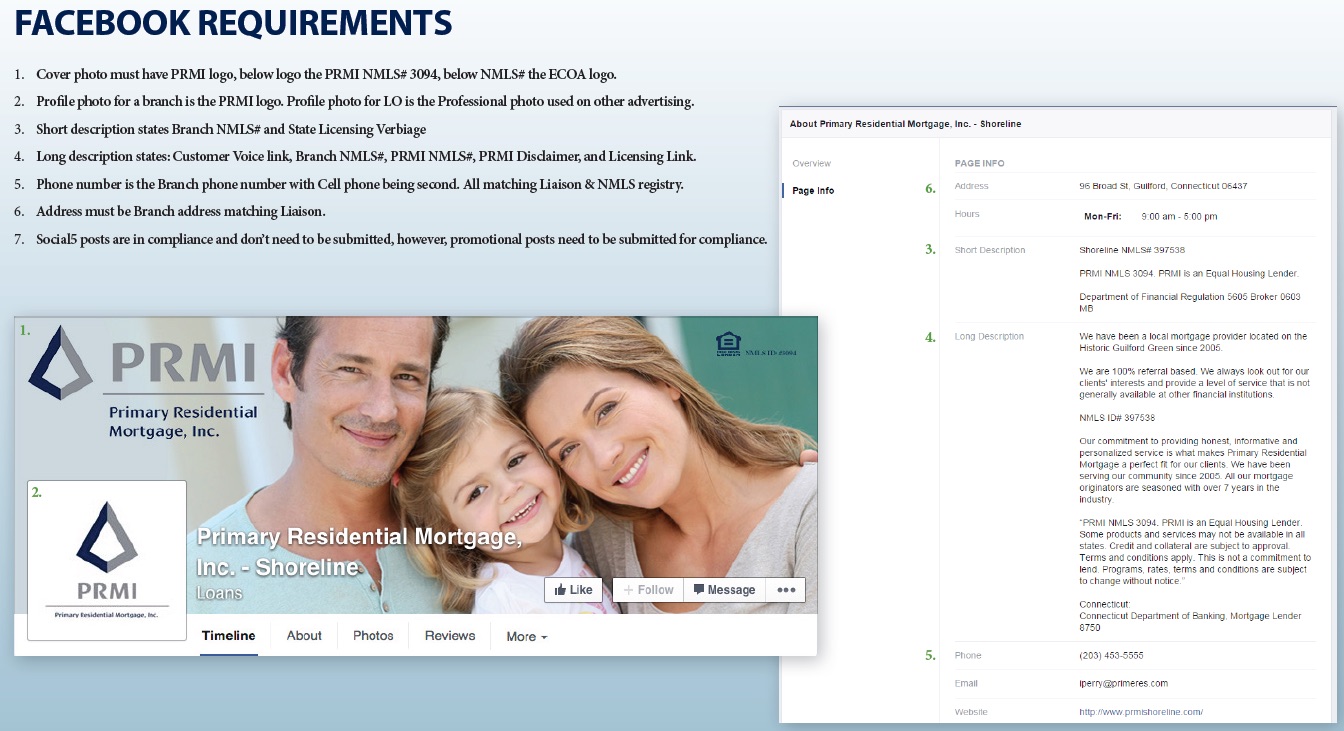

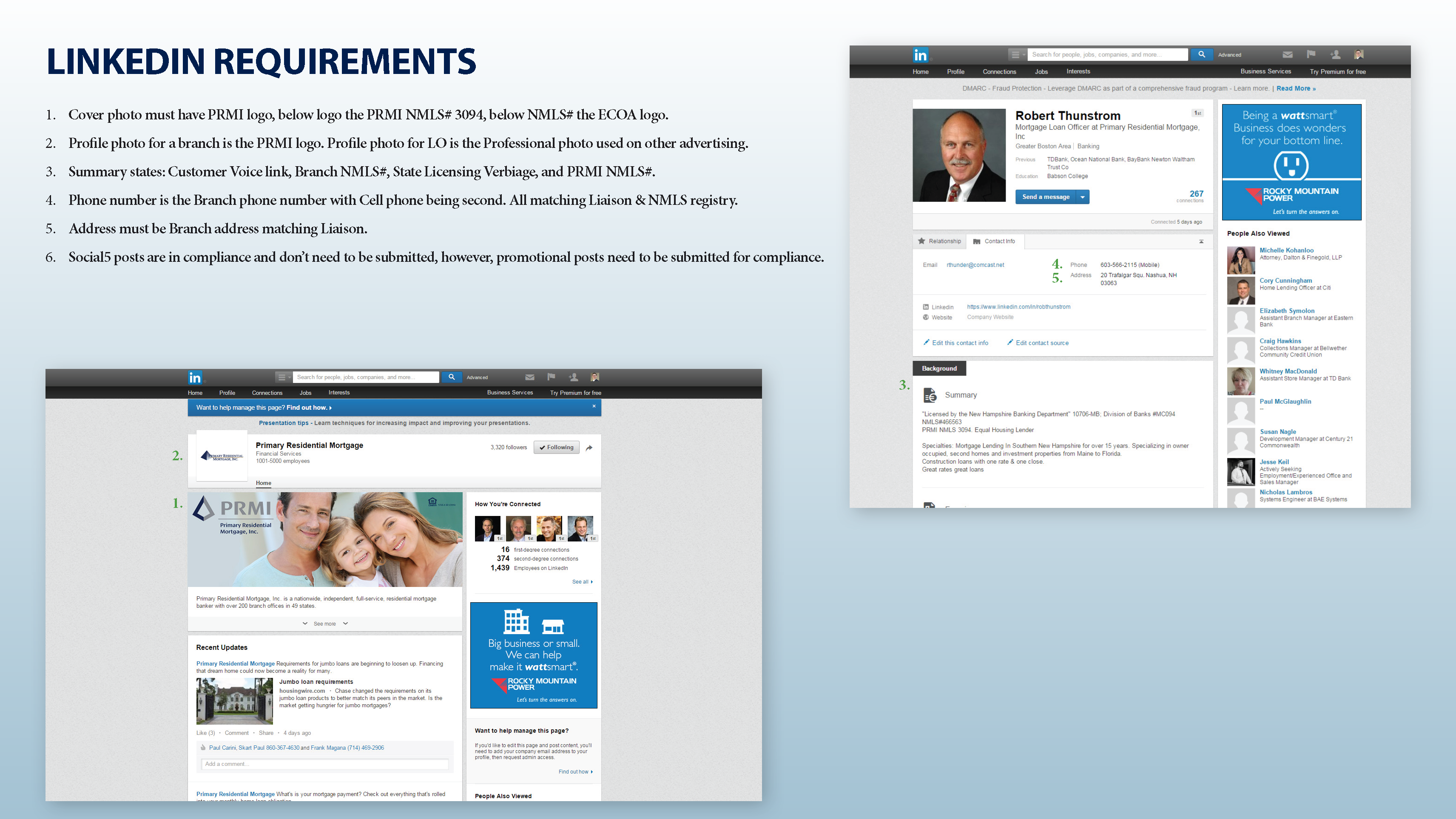

Primary Residential Mortgage, Inc., one of Brandle's customers, has created Social Media Guidelines and Requirements for their loan officers to receive step-by-step instructions. The beauty of the document is that it is simple, gives an illustrated example for each approved social media site, and lists the compliance requirements on each page. PRMI is kind enough to let us share this "best practice" example of how to help loan officers with compliance and good brand standards! Perhaps it will help you with your training program for your "social sales team".

Demonstrate Social Media Compliance with Examples

Some companies manage compliance by managing the loan officer and branch social media accounts centrally. This blog post is written for those mortgage companies who allow each branch and each loan officer to manage their own social media accounts.

Creating a document complete with examples and instructions is not only a great way to demonstrate social media compliance to your loan officers, it's also an opportunity to reinforce corporate brand standards. The cumulative web presence of all your branch and loan officer sites is significant and each site should be an extension of your brand. Make sure you take full advantage of brand consistency (and regulatory compliance) on all social media accounts that represent your company — customers are watching!

Here are some things to consider in creating your training program and example document.

- Determine which social networks each branch and loan officer is allowed to use for business

- Finalize the corporate brand standards and individual standards (such as a LO photo for the avatar) for each account type (branch or individual)

- Create the brand standards and example templates for each approved network

- Define what is required vs. optional or suggested

- Create a How-To Guide to help LOs quickly update their accounts

Below, I have posted a few pages from the Primary Residential Mortgage Social Media Guidelines & Requirements.

PRMI Facebook Requirements for Compliance

PRMI Twitter Requirements for Compliance

PRMI LinkedIn Requirements for Compliance

PRMI Social Media How-To Tips for Loan Officers

If you need a few more ideas on how to manage mortgage industry social media compliance for your loan officers, do read our blog posts:

- Social Media Compliance & Your Sales Team: 6 Steps to Success

- 3 Social Media Compliance Tools You Need for a Regulated Business

Brandle's Social Media Compliance Checklist for Mortgage may also be a helpful tool.