In every industry, good sales and marketing professionals seek external data to support marketing ideas and business decisions. That is doubly true in a regulated industry, like financial services, where a decision could cost the company high compliance fines. So when external data is available, such as meaningful survey results showing social media industry trends, it's a great idea to leverage the findings to update, change, or confirm your existing social media programs.

In every industry, good sales and marketing professionals seek external data to support marketing ideas and business decisions. That is doubly true in a regulated industry, like financial services, where a decision could cost the company high compliance fines. So when external data is available, such as meaningful survey results showing social media industry trends, it's a great idea to leverage the findings to update, change, or confirm your existing social media programs.

Recently, Putnam Investments and Socialware conducted social media use surveys among advisors in financial services firms. In this article, I present highlights of the Putnam survey and more detail on the Socialware study.

The biggest data point from the Putnam Investment study that demonstrates why you should ramp up your social media program for advisors is:

- The share of advisors acquiring new clients through social media is up sharply to 79% (from 66% in 2014), with the average annual asset gain from these clients standing at $4.6 million.

The top findings in Socialware's Social Media Trends survey are:

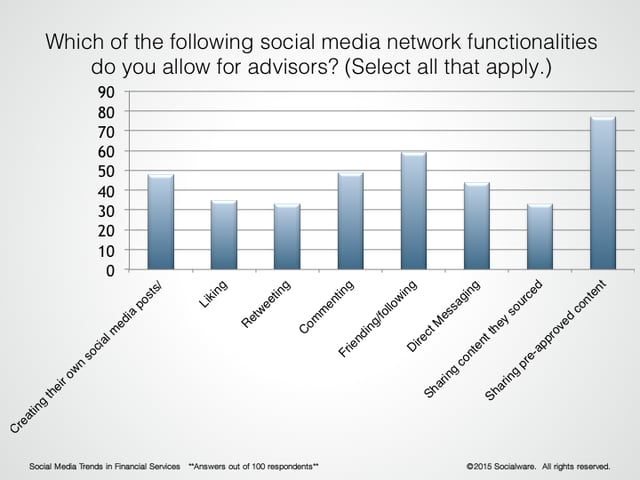

- 48% of advisors are allowed to create their own social media posts, as well as share pre-approved content

- The top challenges center around social media risk management

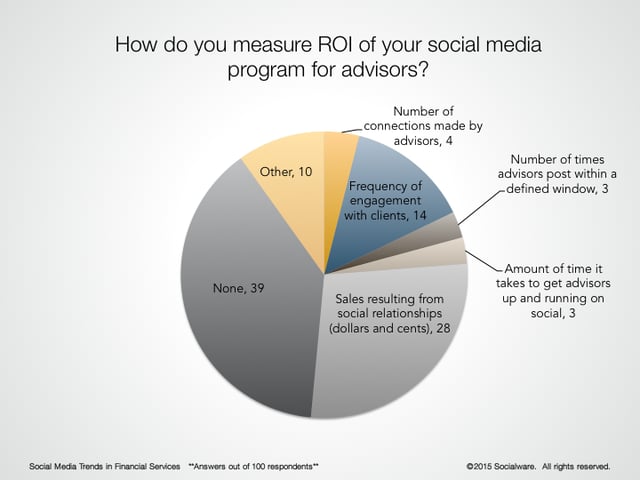

- 39% of firms still have no ROI metrics to assess social media program success

We hope you find information in this article to help you navigate the chasm of corporate risk and build a bridge to social media success!

Social Media for Financial Advisors — Risk Management is Key to Success

The top conversation point around the topic of social media in financial services is definitely COMPLIANCE. According to Thomson Reuters, the average number of social media-related compliance breaches in the United States is at 250 per year among financial institutions. So social media governance, and how you manage corporate risks (such as compliance), is top of mind for the C-suite. However, some of these new findings are showing how social media is bringing in customers, so it could be time to brush up your Powerpoint and show the C-suite the changes occurring in the industry.

According to the Putnam Investments 2015 Social Advisor Study, social media has become an increasingly essential client communication and business-building component for financial advisors across the industry. Putnam recently conducted their third annual study of over 800 financial advisors nationwide. The key findings show that 81% of advisors currently use social media for business, up from 75% last year. 40% of advisors (versus 25% last year) now use four or more networks for business and a growing number (69%) stated that social media played a significant role in their marketing efforts — up steeply from the prior year (56%).

Putnam's research also presents a statistic that should be touted by every social media marketer in the industry to their C-suite executives:

The share of advisors acquiring new clients through social media is up sharply to 79% (from 66% in 2014), with the average annual asset gain from these clients standing at $4.6 million.

The Socialware survey, Social Media Trends in Financial Services, was conducted in September 2015 with 100 respondents participating. The following slides and comments are focused on this specific survey.

The Socialware survey focused on five key questions:

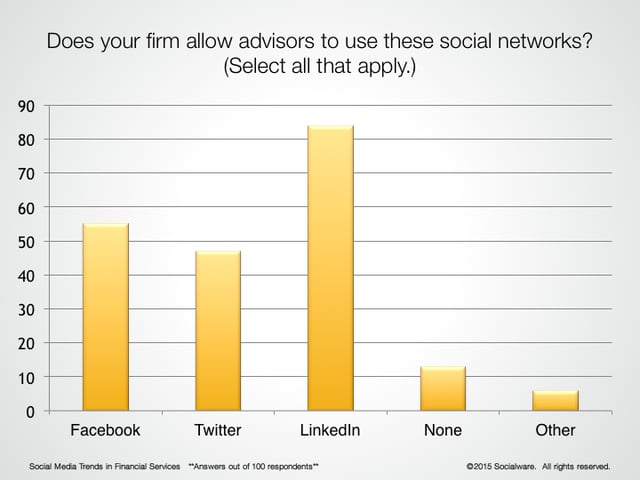

- On which social networks do financial firms allow their advisors to engage with customers?

- Which social functions or actions are advisors allowed to perform?

- What are the top challenges the firm faces supporting a social sales program for advisors?

- How does your firm measure social media ROI?

- Which department is responsible for the social media program and the advisors?

I have presented the results and some insights for four of those questions below. The final question (5), the answer is the Marketing Department along with the Compliance Department are still mostly responsible for the social media program.

1. LinkedIn and FaceBook are still the leading social networks in Financial Services.

These results are not surprising, but what is surprising is that "none" is still a response. Additionally, the respondents who participated in the survey listed "other", which may be Google+ or may be other networks or microsites. Next year, it will be interesting to see the growth in the "other" category and how it breaks out, as well as the reduction in the "none" category. Perhaps the Putnam survey results will inspire these firms to get social.

2. Pre-approved content is preferred, but allowing advisors to create their own content is growing in popularity.

When firms feel confident in their social media governance program (including advisor training), firms are more trusting that their advisors will create quality and compliant content. However, retweeting and sharing sourced content is less popular since it can be difficult to determine whether a source is accurate or compliant (potentially creating corporate risk).

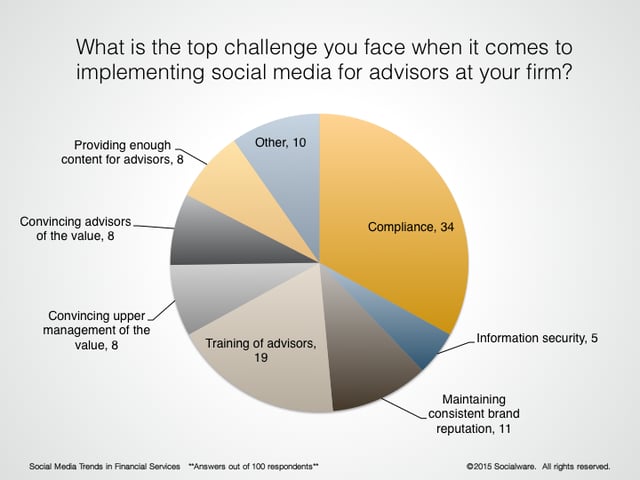

3. Social media risk management (including compliance, training, information security, and protecting brand reputation) are still the top challenges for financial services firms.

Looking closely at the responses below, you can see that the need for increased quality content provided to advisors is another challenge. This is encouraging information, demonstrating advisor interest in providing more content to increase interaction with their social community.

4. SALES resulting from social media interactions are the favorite metric for ROI.

However, the other metrics stated in this chart should be part of every firms social media ROI assessment.

CONCLUSION:

We can boil down all of this information into these three actionable items:

- Manage corporate risks for information security, brand reputation, and regulatory compliance.

- Prepare a library of compliant content for advisors and train advisors how to create their own compliant content.

- Determine your success factors for social media ROI. Make sure they align with your business objectives.

Don't forget that "content" on an advisors social media account is not only the story and conversation happening in the content stream, but it is also the information in the profile description (e.g. the information listed in a LinkedIn in profile or the description area of a Facebook page). So be sure that you are monitoring for the profile description content as well as reviewing the content stream.

Finally, in order to demonstrate full compliance, be sure that you are auditing for rogue accounts and any new blogs, microsites, and new social networks that advisors may be utilizing for business.

A web presence manager (such as Brandle) can help you audit the web for points-of-presence which are associating with your firm as well as ensure correct branding, compliance standards, and disclaimers are disclosed. If you'd like more information on what a web presence manager is and how it works with other SaaS tools, read 3 Social Media Compliance Tools You Need for a Regulated Business.

Together, Brandle and Socialware deliver the only comprehensive social media compliance and risk management solution on the market. Take a look at the Socialware and Brandle webinar to see how the combination can help your firm.