By Role

Use Case FAQ

Sign Up For Our Blog

Social Media Compliance

Social Media Compliance is the process of ensuring that social accounts adhere with company policies and procedures, as well as the laws and regulations that govern your industry. While all companies monitor compliance to some degree for corporate policies and standards, companies in regulated industries must adhere to government regulations regarding use of social media and digital marketing. Regulatory compliance is crucial not only for corporate digital properties, but also for the digital properties of employees.

Benefits of Social Media Compliance

Businesses that are able to achieve compliance across their social media channels may enjoy a number of benefits such as:

- Avoidance of regulatory citations and fines.

- Strengthened brand presence and brand reputation.

- Enhanced social media risk management practices that also protect consumers.

- Improved consumer trust.

Social media compliance allows businesses to create a wide array of social media accounts with strong branding and uniform messaging. Compliance also helps eliminate inconsistencies, errors, or sensitive information that may exist on social media accounts. And social media compliance helps mitigate against both internal and external threats to brand security.

Ensuring Social Media Compliance

Creating a checklist of compliance criteria for each type of social account that relates to your company is a great way to start working toward social media compliance. Several types of common accounts are: corporate accounts, employee accounts, partner accounts, community accounts, sponsorship accounts, etc. Also, be sure to include social network generated pages (such as Facebook Place Pages) in your compliance process.

When conducting a compliance review, it is important to fully understand all guidelines, rules, regulations, and policies that will shape your corporate definition of “social media compliance”. Some of the items to consider in this process include:

- National and State regulations for your industry

- Current NLRB law on social media and the employer/employee relationship

- Corporate Social Media Policy

- Corporate Brand Standards

- Employee Brand Advocacy Policy (and guides for monitoring)

- Requirements for Social Accounts (such as posting date schedules)

This is just the beginning. Creating –– and implementing –– a social media compliance plan at a large corporation requires several distinct phases and coordination between corporate marketing, HR, Legal, Compliance, Risk, Sales, and then local management of accounts for retail outlets, branches, offices, etc.

In order to manage a successful social media compliance program, a best-in-class process follows these steps:

- Centralize Social Media Governance. Centralizing governance enables both corporate professionals to set and maintain global standards and compliance while working collaboratively with local social media managers. Local employees handle the day-to-day activities of posting and replying to customers; corporate pros oversee that compliance adherence and provide guidance.

- Establish Team Roles. Large companies require a dedicated team lead that communicates and guides compliance across departments.

- Create a Social Media Governance Plan. Compliance is part of an overall governance program. Creating a strategic governance with compliance expectations will help every department keep on top of their piece of the compliance efforts.

- Utilize Modern Technology. Manually tracking every point-of-presence (POP) related to a large corporation can be time-consuming and fraught with human error without using technology. Businesses need to leverage technology to identify and monitor all branded and brand-related POPs to maintaining compliance and effectively report on progress and compliance.

- Train Employees. Employee training on social media compliance will help companies avoid compliance infractions. Training employees to understand what violates company policy, standards and government regulation is essential to protecting brand image and preserving compliance. Giving templates and designs that include compliant examples is a great training tool.

Regulated Industry Social Media Compliance

There are industries that have specific laws and regulations for using social media to communicate with consumers. The key industries that need to adhere to externally regulated compliance standards include: Financial (including Mortgage companies), Healthcare, Pharmaceutical, and Alcoholic Beverage. To see the specific U.S. requirements attached to each industry, take a look at our Regulations and Laws page in our resources.

Companies need to be aware of their responsibility for the compliance of employee accounts –– as well as corporate accounts. For example, a financial company can be fined for any non-compliant actions of their mortgage loan officers' and financial analysts' social accounts. To emphasize a point: companies can be held accountable for the information displayed by their employees on social media.

In addition to employee accounts, companies must be able to monitor the following pages to ensure social media compliance:

- Vertical Social Networks. Social networks relating to a niche industry.

- Auto-Generated Pages and URLs. Pages created automatically by social media sites like Facebook.

- Community Generated Sites. Including benevolent fan pages and potentially damaging pages created by “haters” or counterfeiters.

- Channel Partners, Agents, and Representatives’ Accounts. Third-party associated accounts of other businesses or professionals.

- Fraudulent Sites. Created by counterfeiters to damage brand reputation.

Creating a criteria checklist of the necessary items required in social media use is essential. The mortgage industry, for example, has a significant criteria list since they are not only governed by the FFIEC, but by each state's regulations as well. To help, we have created a Mortgage Compliance Checklist which will get you started.

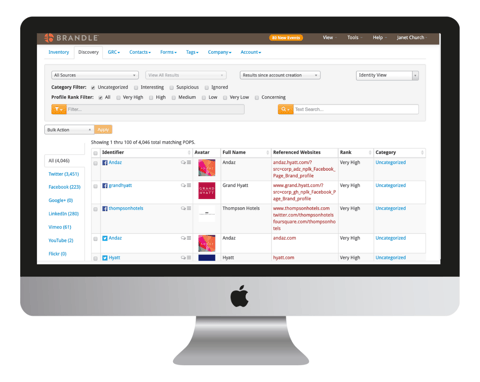

How Brandle Helps Your Social Media Compliance Program

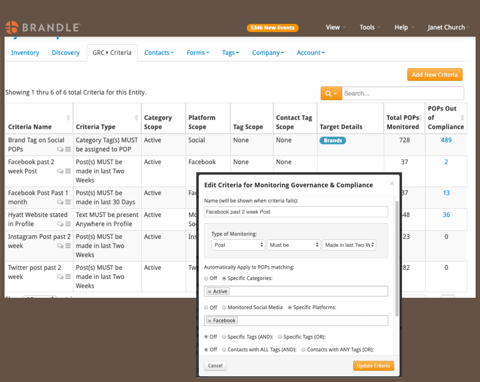

The Brandle Presence Manager Plus the GRC Module covers your compliance needs for all POPs (points of presence) whether they are social media, websites, industry sites, or other digital channels. Gain compliance for all social media profiles and monitor posts for Facebook and Twitter.

Brandle GRC Module is designed to search for your compliance criteria and send you alerts when accounts fail. You can pull reports on compliance status on all social accounts or a subset for robust reporting.

It's our goal to make your compliance job easier! See Brandle GRC here.

Helpful Resources

Social Media Compliance Checklist for Mortgage Companies

This white paper highlights the required industry regulations and how to develop a sound social media governance program.

- Discover why a social media audit is your first step.

- Learn the elements of a compliance review.

- Determine what elements you need in a social media policy and training program.

- Define your governance process and which stakeholders need to be involved.

Enterprise Social Media Audit Case Study

This white paper by Brandle® highlights how an automated system outperforms a manual web and social media audit.

- Discover why multiple spreadsheets can’t keep up with the digital world.

- See how a manual audit missed almost 50% of a global company’s brand presence.

- Learn why a manual audit put a regulated company at greater risk!

TRUSTED BY

At Brandle, we help companies implement social media compliance plans to gain a focused and controlled model of their digital presence. With the Brandle Presence Manager, global companies can gain better control over their social media presence, as well as improved oversight of other organizations and people who associate themselves with their brand. All of these online points-of-presence are customer touch points that add, or subtract, from brand reputation.

If you are interested in learning the steps to create a best-in-class social media compliance program, contact us today to set up a demo and gain control of your brand presence!

Brandle®, Inc. is dedicated to providing a comprehensive system for companies to manage the properties of their brands, identities, and relationships across the web and on all major social networks including Facebook, Twitter, YouTube, Instagram, LinkedIn, VK, and more. It is our mission to be the trusted source for social media governance and web presence management and to provide functionality that helps every enterprise manage, secure, and protect their brands.

Stay current with social media governance strategies! Sign-up for our Blog

©2022 Brandle, Inc. All rights reserved.

Schedule a Demo of the Brandle Presence Manager